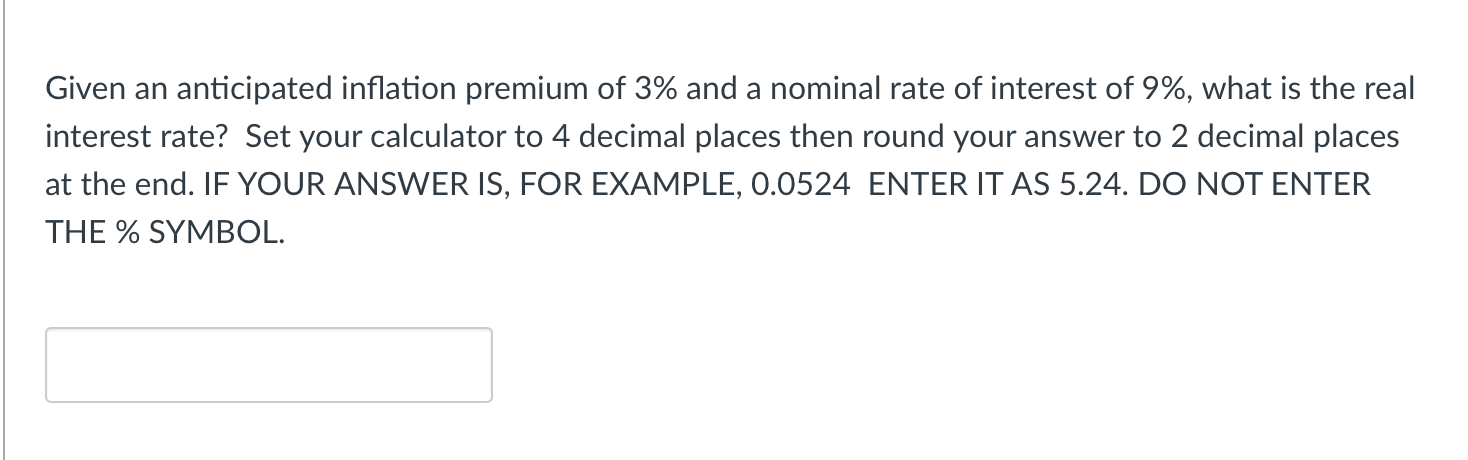

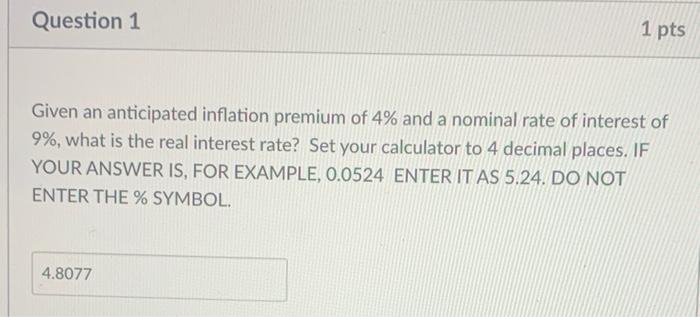

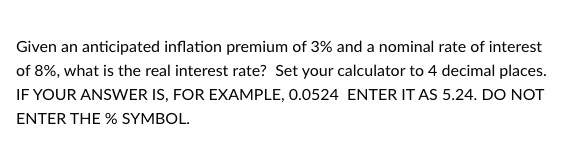

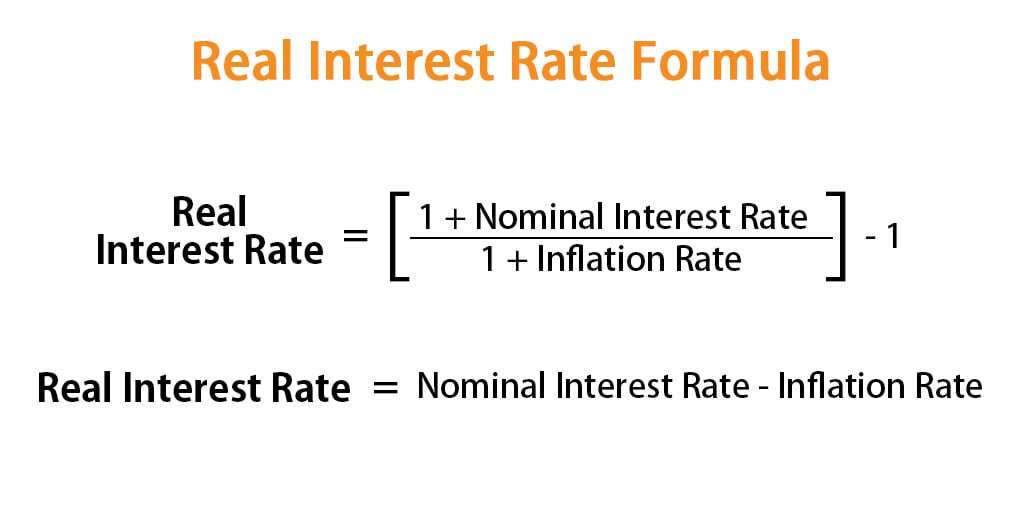

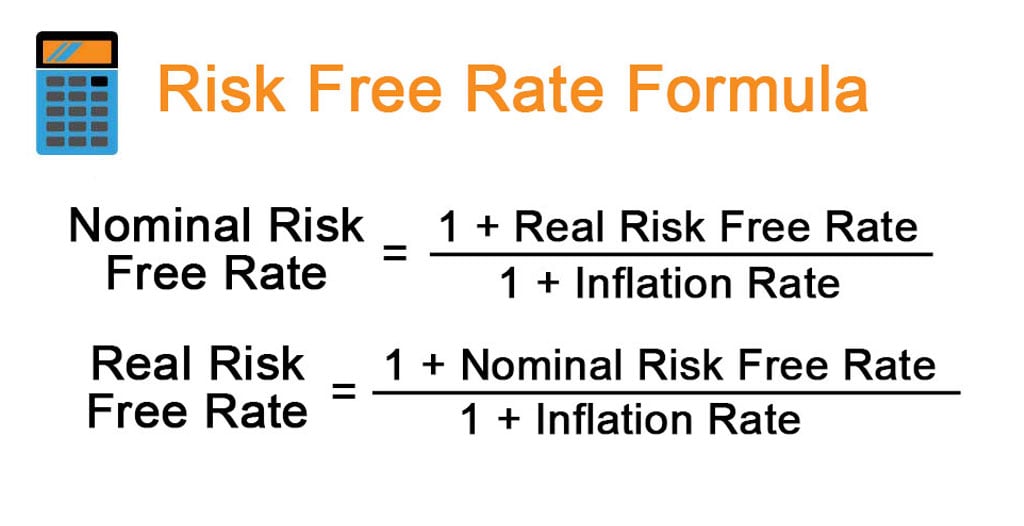

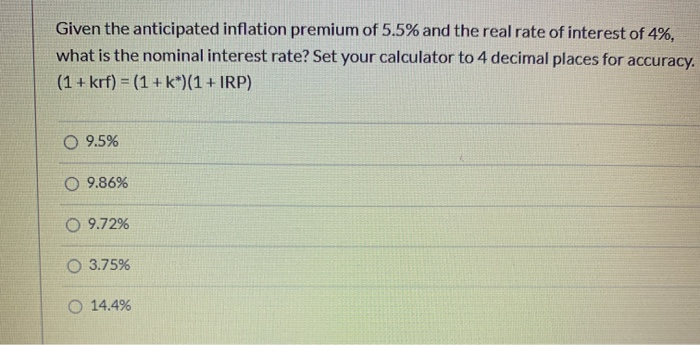

SOLVED: Given an anticipated inflation premium of 3% and a nominal rate of interest of 8%,what is the real interest rate? Set your calculator to 4 decimal places IF YOUR ANSWER IS.FOR

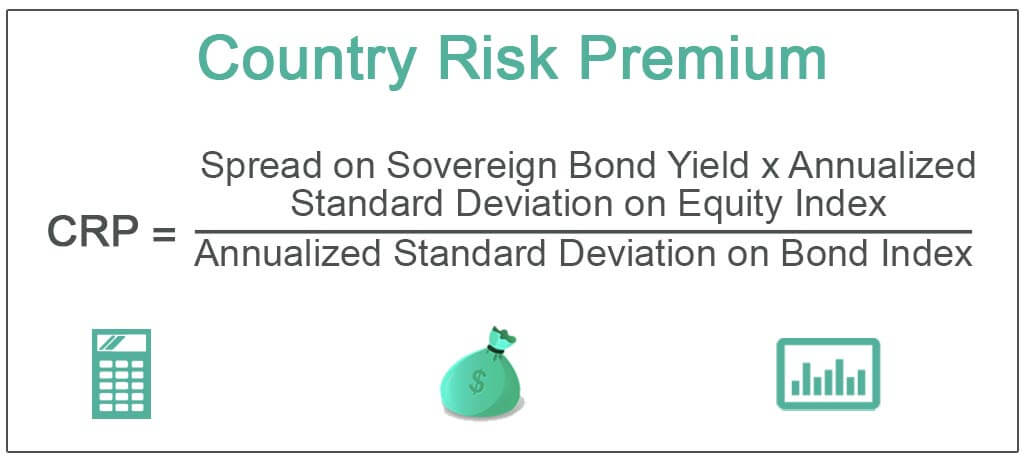

Interest Rate as the Sum of Real Risk-free Rate and Risk Premiums - AnalystPrep | CFA® Exam Study Notes

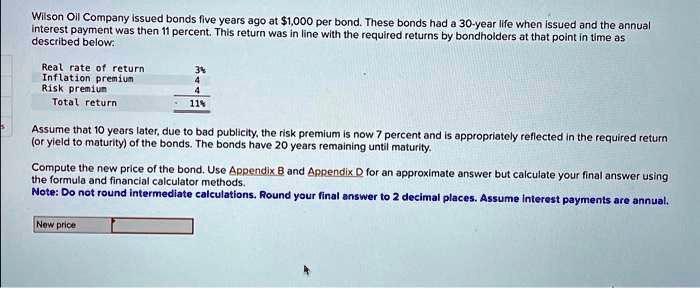

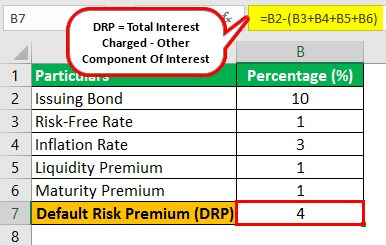

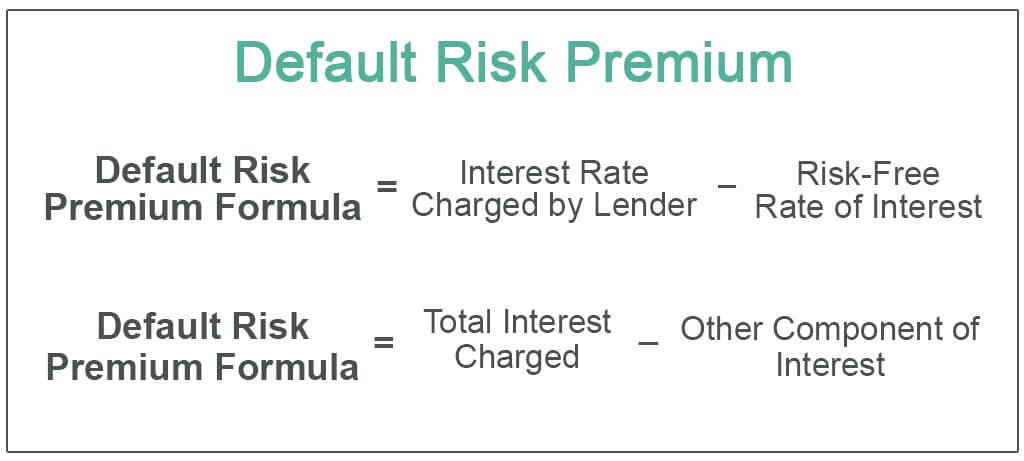

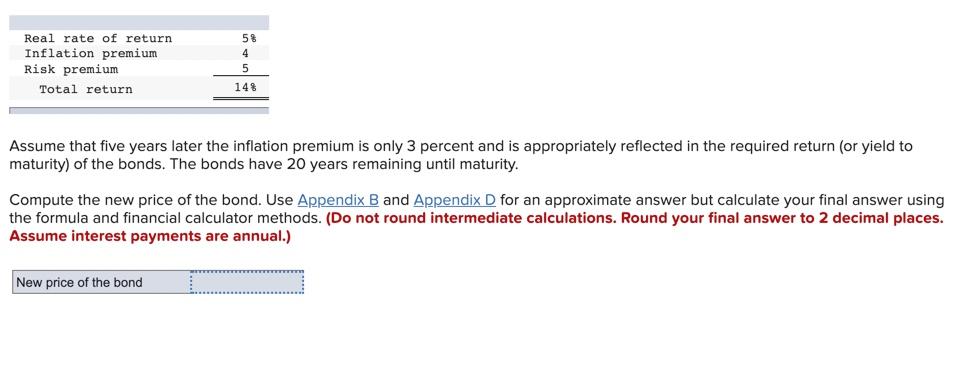

SOLVED: interest payment was then 11 percent.This return was in line with the required returns by bondholders at that point in time as described below. Real rate ofareturn Inflation premium Risk premiun

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Inflation_Adjusted_Return_Nov_2020-01-c53e0ae26e8f404fb1ce91a9127cbd3b.jpg)