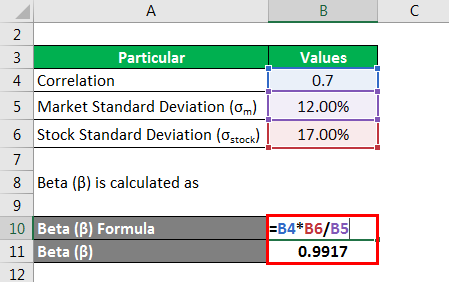

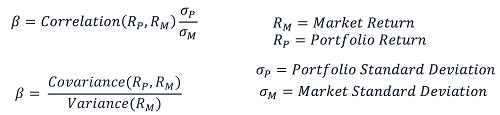

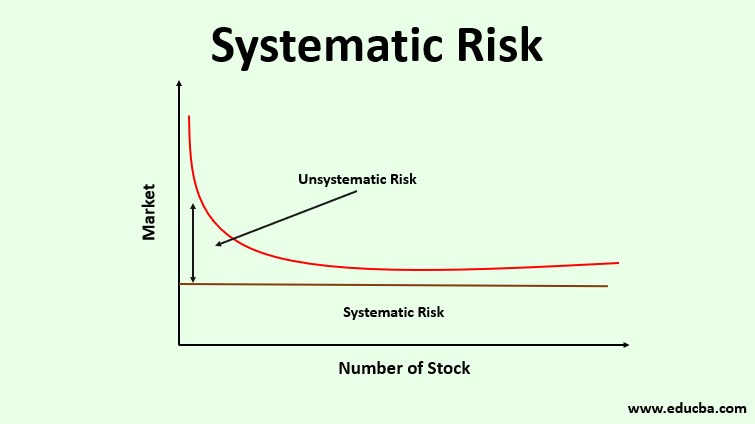

What is Systematic Risk (aka Beta)? How to Calculate Beta of a Stock? - Everything You Need to Know.

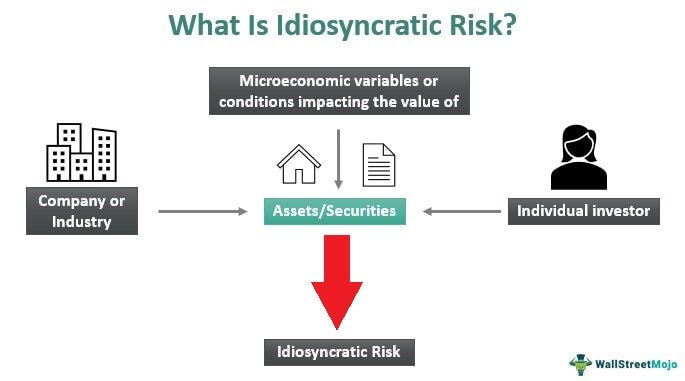

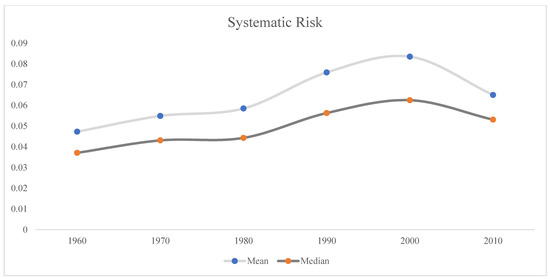

JRFM | Free Full-Text | Time-Varying Risk and the Relation between Idiosyncratic Risk and Stock Return

Idiosyncratic Volatility Calculated by the Fama–French Three-Factor... | Download Scientific Diagram

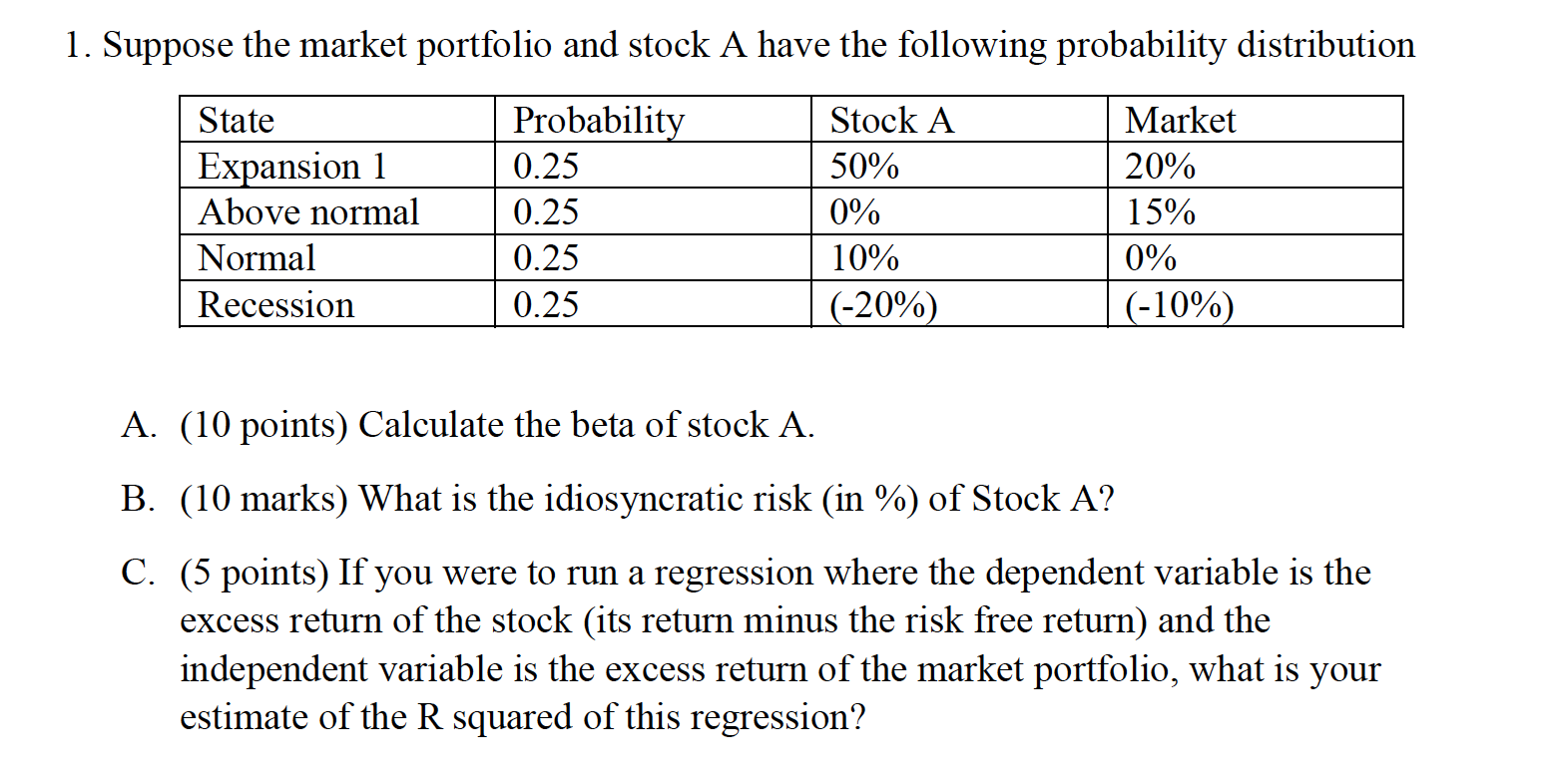

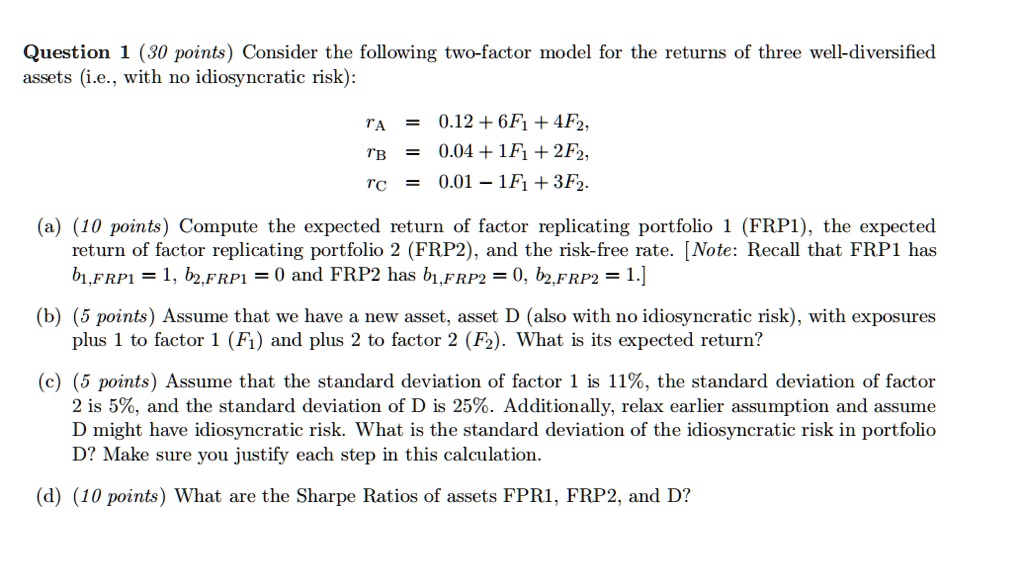

SOLVED: Question 1 (30 points) Consider the following two-factor model for the returns of three well-diversified assets (i.e , with no idiosyncratic risk): rA 0.12 + 6Fi + 4F2, 0.04 + 1Fi +

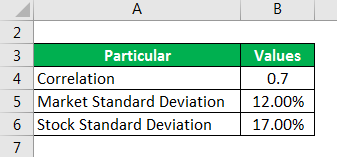

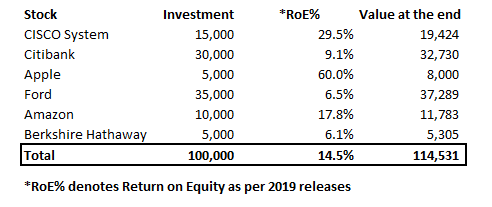

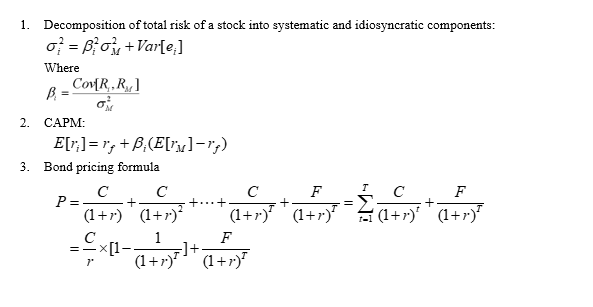

CALCULATION OF FAIR VALUE OF PROPERTY AND UNSYSTEMATIC RISK(IDIOSYNCRATIC RISK OR DIVERSIFIABLE RISK)

/151563103013/151563103013_gt5.png)

:max_bytes(150000):strip_icc()/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)