python - Compute tangency portfolio with asset allocation constraints - Quantitative Finance Stack Exchange

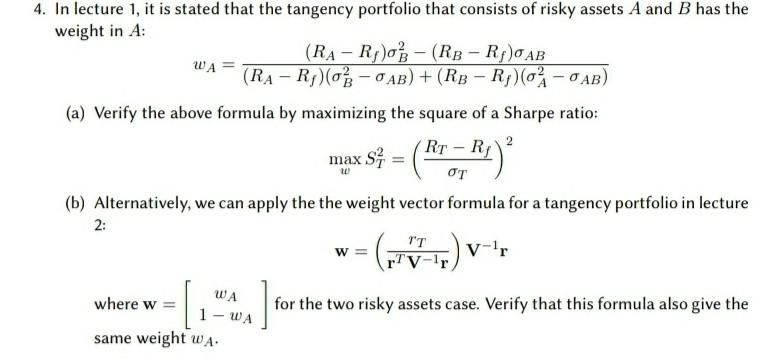

modern portfolio theory - How to derive the CAPM from maximizing the Sharpe ratio? - Quantitative Finance Stack Exchange

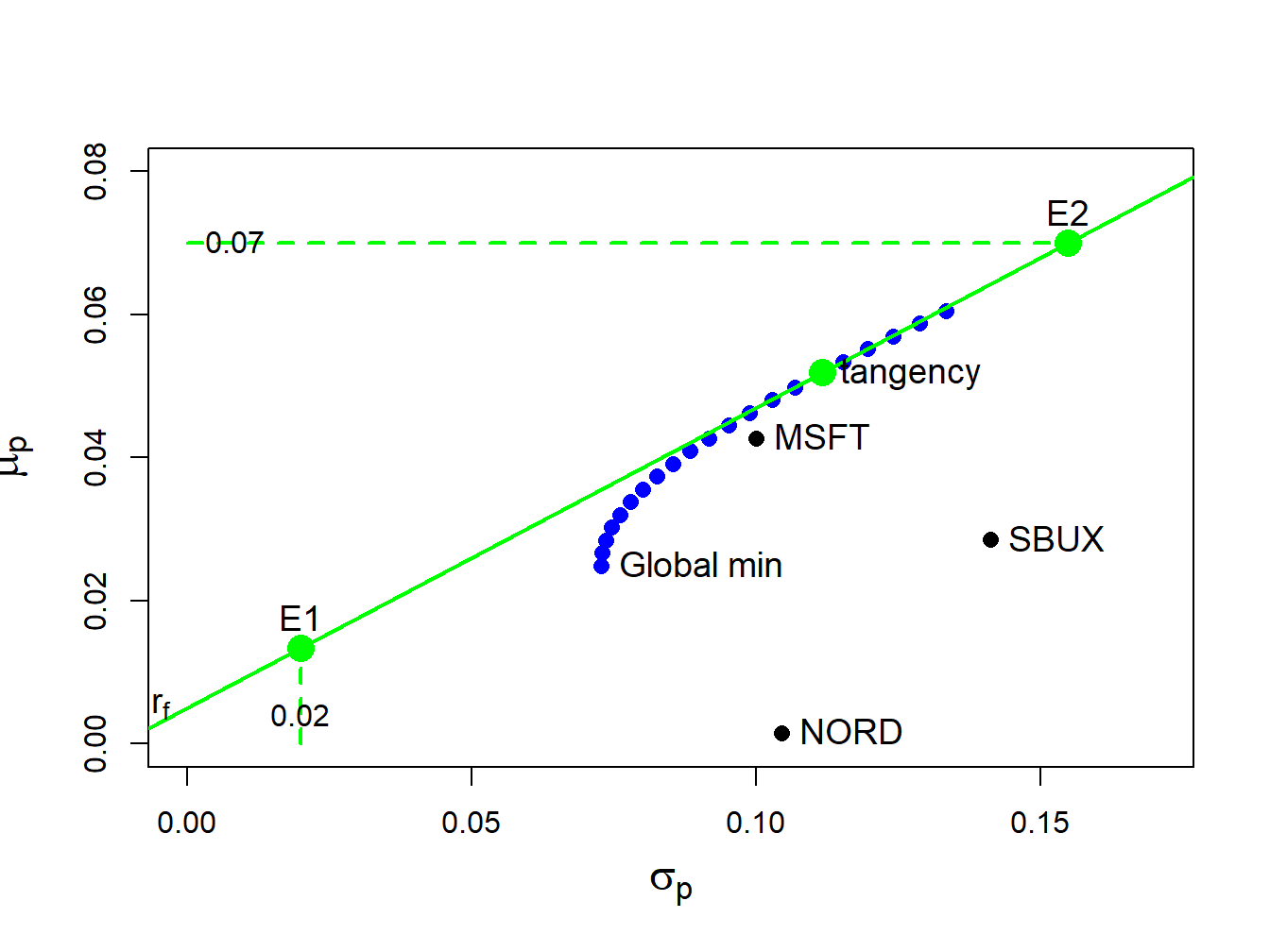

12.5 Computing Efficient Portfolios of N risky Assets and a Risk-Free Asset Using Matrix Algebra | Introduction to Computational Finance and Financial Econometrics with R

![SOLVED: Problem 1. [Finding tangency portfolio] Suppose we have two risky assets with the same variance 13 The correlation of these two assets is 0 0.5 The expected return for asset 1 SOLVED: Problem 1. [Finding tangency portfolio] Suppose we have two risky assets with the same variance 13 The correlation of these two assets is 0 0.5 The expected return for asset 1](https://cdn.numerade.com/ask_images/50c19eff4b8044f78afe3224d0fe56fa.jpg)